Before we dive into the minds of investors, it is crucial we understand what the current state of global investment is looking like for startups!

The global investment landscape has witnessed notable shifts in recent quarters. According to a report by Dealroom, Q2 2023 has seen a staggering 43% dip in VC investments, dropping from $144 billion in Q2 2022 to $81 billion.

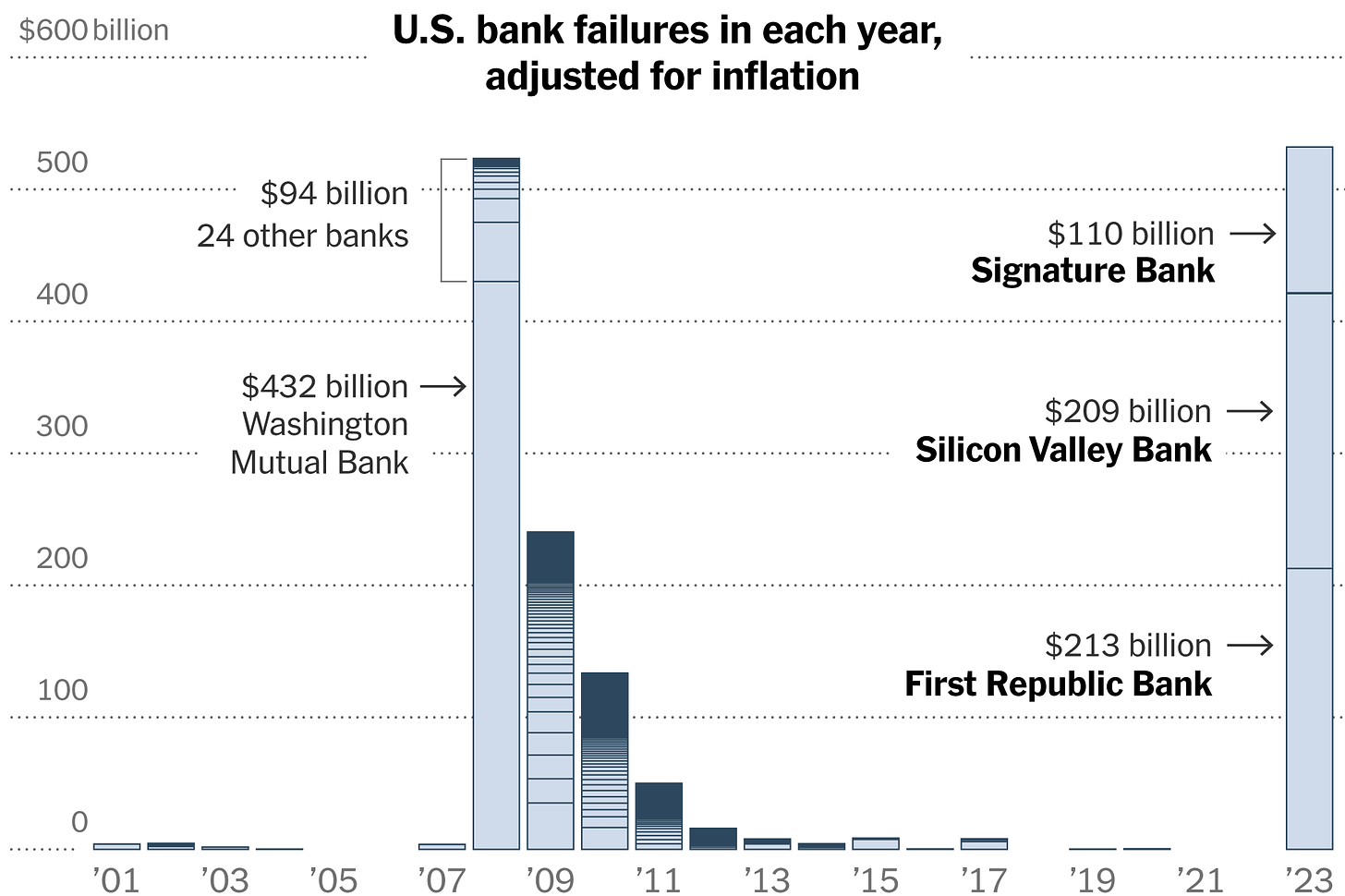

The challenges stem from the recent bank failures, inflation concerns, and geopolitical tensions like the Russia-Ukraine conflict, collectively shaping a more cautious outlook for the rest of 2023.

While Fin-tech and SaaS sectors maintain their growth trajectory, attracting a broader investor base, including micro VCs and global funds in India, the venture capitalists (VCs) are reassessing their funding strategies.

What are Investors looking for in Startups?

With insights into the investment landscape of 2023, let us now understand what investors expect from startups.

Here is the list of the top eight strategies to effectively secure funding for your venture.

Skin in the Game

A passionate founder is easy to come by, but someone willing to stand their ground through multiple setbacks garners the investor’s attention. While bootstrapping your business may sound counterintuitive, it significantly increases the appeal of your startup as it demonstrates your commitment to your vision.

Emerging Sectors

Investors are doubling down on early-stage deals and emergent domains like gaming, health tech, electric vehicles, and AI-driven solutions. They are willing to bet on startups whose core traits are resilience and adaptability.

The Team

A strong team with diverse skill sets and relevant industry experience enhances your startup’s credibility and ability to navigate challenges. Investors recognise that a startup’s success depends on the quality of its management team. This past year has underscored its importance with Agro AI, Fast and many others shutting down, making it a critical factor in investment decisions.

Unique Selling Points (USPs)

Investors love startups that stand out in a competitive landscape. While a unique product or service is advantageous, the ability to articulate strategies for market domination is equally crucial. If your startup showcases potential for long-term market leadership, it will resonate profoundly with discerning investors.

Business Plan

A robust and comprehensive business plan is the foundation for attracting investors’ interest. While originality is valuable, a thorough proposal that outlines the path to profitability or growth is equally essential. Prospective investors seek clarity on your startup’s goals, market potential, and differentiation, even if the market is just emerging.

The Funding Equation

Striking the right funding balance is a delicate art. You must precisely gauge your financial requirements, ensuring you neither overreach nor fall short. This prudent approach, bolstered by accurate revenue projections and robust financial strategies, assures investors of a well-calibrated growth trajectory.

Intellectual Property

In this digital age, safeguarding intellectual property is paramount. If you prioritize legal protections, you have one up over other startups. Investors will value your commitment to protecting your assets, as it safeguards their investment and supports long-term growth.

The Endgame: A Thoughtful Exit Strategy

While planning for an exit might seem premature, it demonstrates foresight and investor alignment. A well-defined exit strategy assures investors of potential returns and demonstrates an understanding of their expectations. Investors appreciate entrepreneurs who anticipate the need to provide a profitable exit opportunity.

Closing thoughts

In a dynamic and ever-evolving startup ecosystem, the symbiosis between entrepreneurs and investors is fueled by a shared vision of innovation, growth, and opportunity.

By embodying the traits of resilience and strategic foresight, you can craft a compelling narrative that captures investor enthusiasm and sets the stage for your startup to secure funding and flourish in its quest to redefine industries, drive change, and achieve lasting success.

How many of these strategies are you implementing? Do you have a different roadmap to impress the investors?

Comment your thoughts below! Let’s have a full-blown discussion as a startup community!

Cheers!